Making C.E.N.T.S of Your Finances

May 15, 2019

Before you click out and procrastinate thinking about your finances AGAIN, take a deep breath, count to ten, and realize that it’s really not as hard as it’s sometimes made out to be. College students get a fair amount of flak when it comes to their finances- from taking on monumental loans with little preparation to pay back, to living on ramen, and buying endless Starbucks when a drip machine would get the job done 10 times over for a fraction of the cost – we sometimes take on the stereotype of being young dumb and broke. (Thanks Khalid for at least making the judgement a catchy tune for those of us in the trenches.) Believe it or not, it is possible to get a hold of your finances on your own and even have some fun along the way.

Credit

Whether you have good credit, bad credit, or no credit whatsoever – it’s incredibly important to at-least know where you stand. There are plenty of tools available to start this process and get you tuned in to knowing your credit score. The first place to start is with your banking institution. Chances are your bank offers easy to use software that will help you monitor your credit score. Another totally free and safe means to gain an understanding of your credit is Credit Karma. Creating an account allows you to monitor changes, maintain a pulse on accounts, and get tips for improvement along the way. Once you start to understand your credit, seeing positive changes is the adulting equivalent to getting a bump in your weekly allowance. Mastering credit unlocks opportunities otherwise unattainable in the financial world, just as that extra $1/week in allowance unlocks a kid’s possibilities for stepping up their game in the lunch line or the ice-cream truck.

Earning

Alright, this one is probably a given, but with that being said, how about getting a job!? Yes, being a college student is absolutely a job, with demands, rewards, and deadlines galore. And yes, this job will absolutely pay off in time, but for now it is important to earn in any way you can while still getting the degree. Working on campus is a great way to grow your resume, earn some cash, and gain some experience in the working world. Opportunities outside of campus are abound, from hosting, serving, cashier, childcare, the list goes on. Stop by Counseling and Career Services to start your search for short-term or long-term career options.

Networking

Ok so networking may not immediately seem like it has anything to do with managing your finances but that could not be further from the truth! The college experience is your introduction to the professional world, the start of branding yourself as qualified and desirable candidate for whatever work it is that your heart desires, so ALWAYS keep that in mind! Who you meet on your path in education may be there as you cross the threshold into the working sphere. Start by making a Linkedin profile, connecting with colleagues, mentors, and peers. From there, you can use the site to network, scope out opportunities and to get a formula for your future success.

Tracking

Recording your income and expenses is essential in your pursuit to understanding and mastering your finances. If at all possible, register for Personal Finance 101 here on campus. The class holds valuable information that can unlock the ease of budgeting and financial planning for your future. If that’s not possible for you, or if you just want to get started NOW, then begin by reviewing your bank statements for the past 2-3 months. Reviewing where, when, and how your money is spent will be the first step in knowing what is necessary in your budget and what could be trimmed for saving. You’ll want to record all cash inflows versus expenses, then you’ll be able to execute a plan of improvement, set goals, and understand where your money is going.

Saving

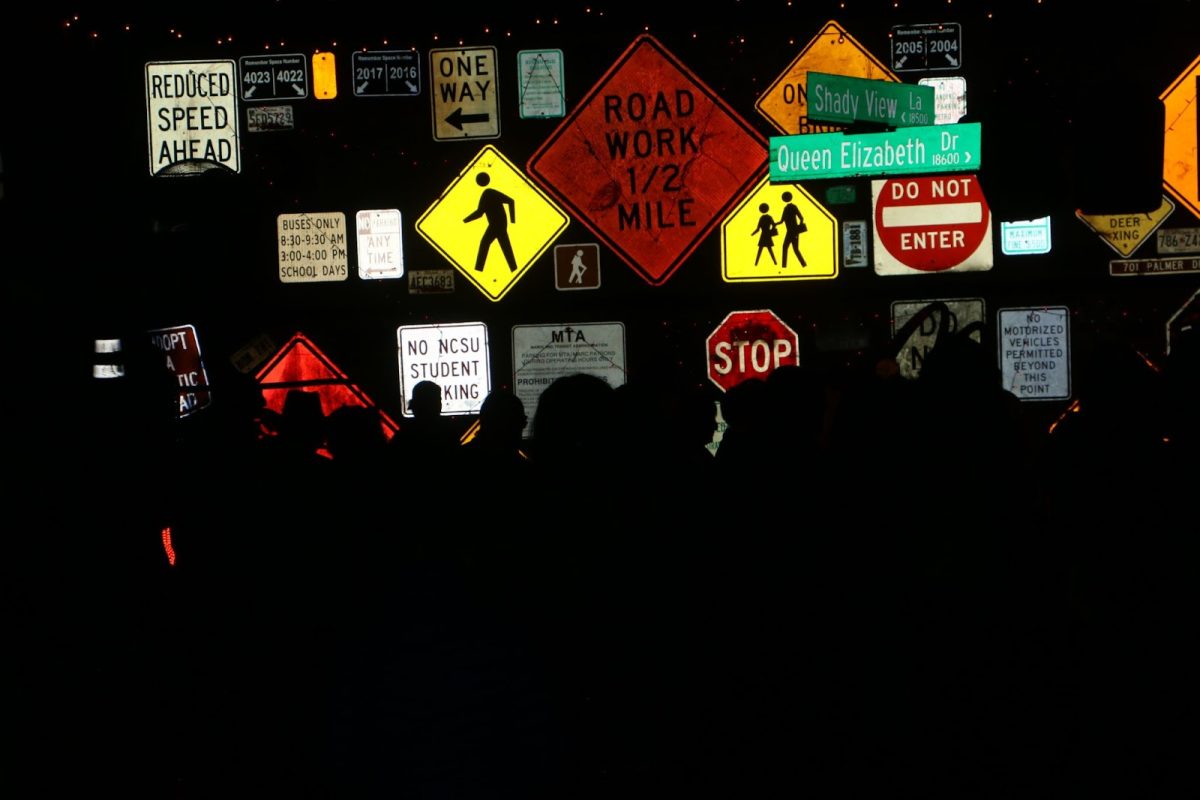

So you may be wondering by the end of this article, where’s the fun promised in the introduction? Look no further, because believe it or not, saving IS the fun part. When you take the reins on your finances and begin to save toward your future YOU decide what that future holds. Say you want a new car to get you back and forth from campus, maybe some fancy new wireless headphones to listen to class PowerPoints, or maybe – just maybe – you’d like to plan a trip over summer to unwind after a tough year of academics, whatever it is, saving is the key ingredient to making any and all of those possibilities a reality. Setting short and long-term goals for saving helps to motivate you and once attained, the reward is oh so sweet! Opening a savings account and setting up a scheduled deposit from your checking is a great introduction to get yourself used to setting some funds aside. Start small, but don’t stop there, looking ahead 5, even 10 years down the road can help you prepare for life’s winding roads ahead.